- Branches near me

- Haryana

- Sirsa

- Arniawali

SMC Global Securities Limited

- Ground Floor, Dabwali Road

Arniawali

Sirsa - 125055 - Near SBI ADB Branch

-

- Open until 06:00 PM

- Call Get Direction

- Branch Office

Looking for a Better Demat Account

Social Timeline

With an award-winning financial service record, SMC is simplifying more than 20 lakh unique clients’ money challenges! #SMC #SMCGlobal #Investment #StockTrading #StockMarket #InvestmentPortfolio #MoneyChallenges #Finances #EasyInvestment #Investment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia #SMC #SMCGlobal #Investment #StockTrading #StockMarket #InvestmentPortfolio #MoneyChallenges #Finances #EasyInvestment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia

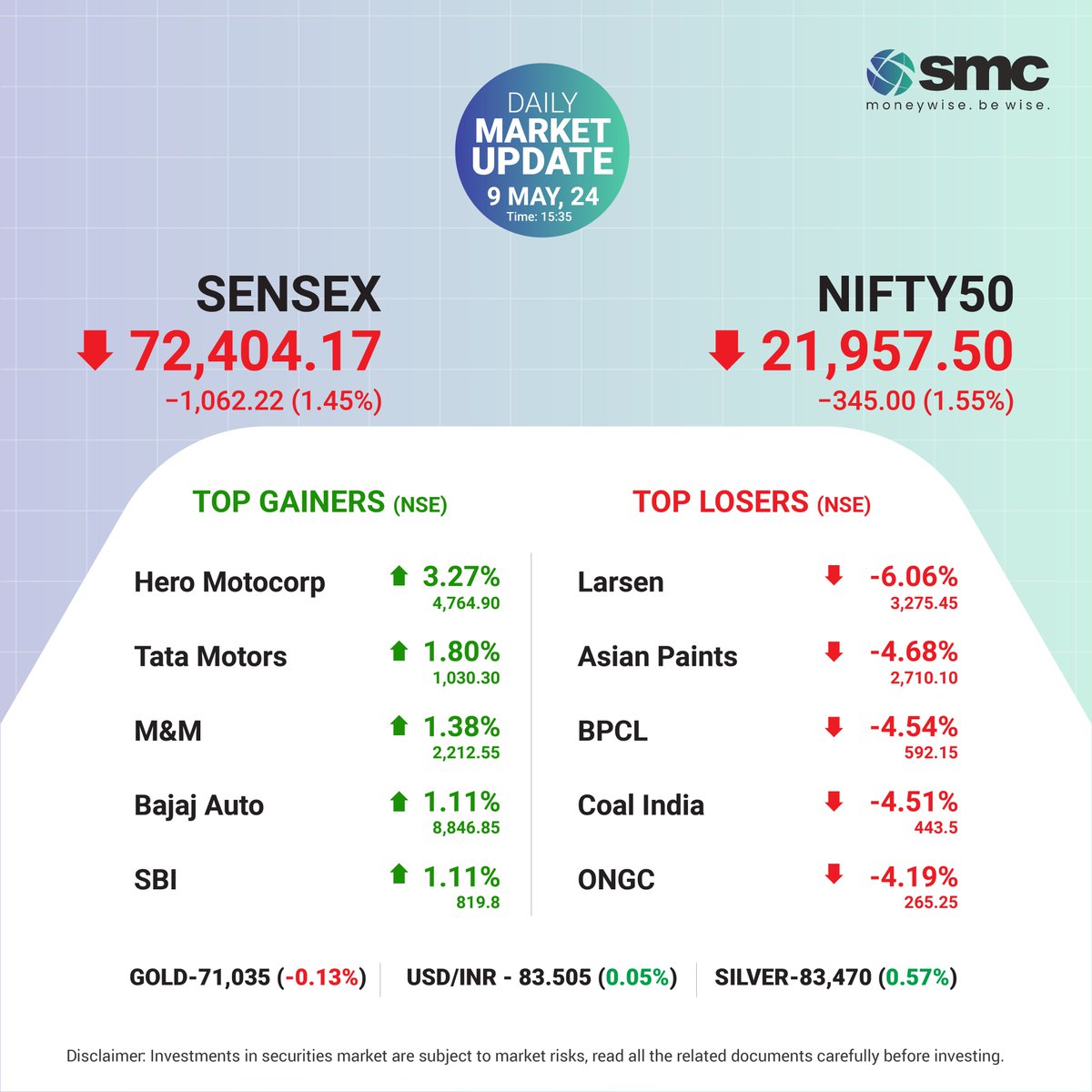

#dailymarketupdate Bringing you today’s Market Update along with the list of Top 5 Gainers & 5 Losers from the Nifty 50. Did you invest in any one of them? Share in the comment’s section below. #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks https://t.co/aERG2rhPBS #dailymarketupdate #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks

With an award-winning financial service record, SMC is simplifying more than 20 lakh unique clients’ money challenges. If you want to simplify yours, visit: https://t.co/XiKjGq73o8#SMC #SMCGlobal #nifty50 #StockMarketindia #StockMarket https://t.co/SLUqLD8qIZ #SMC #SMCGlobal #nifty50 #StockMarketindia #StockMarket

Honouring the unmatched contributions of Guru Rabindranath Tagore! #SMC #SMCGlobal #MoneywiseBeWise #GuruRabindranathTagore. #RabindranathTagore #RabindranathTagoreJayanti #Investment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia #SMC #SMCGlobal #MoneywiseBeWise #GuruRabindranathTagore #RabindranathTagore #RabindranathTagoreJayanti #Investment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia

Cricket fever hits its peak! Are you caught up in the excitement? #SMC #SMCGlobal #MoneywiseBeWise #CricketLovers #T20Cricket #CricketFans #CricketFever #Investment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia #SMC #SMCGlobal #MoneywiseBeWise #CricketLovers #T20Cricket #CricketFans #CricketFever #Investment #Trading #DalalStreet #MutualFund #Sensex #Nifty50 #NSE #BSE #StockMarketIndia

#dailymarketupdate Bringing you today’s Market Update along with the list of Top 5 Gainers & 5 Losers from the Nifty 50. Did you invest in any one of them? Share in the comment’s section below. #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks https://t.co/jq0SSeWAK3 #dailymarketupdate #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks

IPO Alert : Indegene Limited Fresh Issue : 16,814,159 shares Offer for Sale : 1,081 Cr Watch the full video and decide if you want to get hands on Indegene IPO! Disclaimer- The information provided on our platform is intended only for simplification and education purposes, and should not be considered as an investment advice. #finance #financetips #investment #investingtips #education #financialfreedom #financialliteracy #reelsindia #reelkarofeelkaro #explore #finance #financetips #investment #investingtips #education #financialfreedom #financialliteracy #reelsindia #reelkarofeelkaro #explore

#dailymarketupdate Bringing you today’s Market Update along with the list of Top 5 Gainers & 5 Losers from the Nifty 50. Did you invest in any one of them? Share in the comment’s section below. #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks https://t.co/MxAoAMWIDq #dailymarketupdate #smc #smcresearch #marketupdate #nifty #topgainers #toplosers #MarketWatch #Stocks

Two Stock Ideas of the Week! Bringing two Fundamental Stocks of the week to strengthen your portfolio! #SMC #OnlineTrading #StockTrading #StockIdeas #SMCResearch #Wealthcreation #wealth #stocks #shares #stockmarket #sharemarketstudies https://t.co/9OkWWGFd67 #SMC #OnlineTrading #StockTrading #StockIdeas #SMCResearch #Wealthcreation #wealth #stocks #shares #stockmarket #sharemarketstudies